Meet the Team

Dr. Gabriel Bietz

Dr. Gabriel Bietz is the founder and Chief Investment Officer of Mosaic Equity Group. He has more than 17 years of experience in operations and commercial real estate investment management. Gabe is involved with acquisitions, dispositions, general partnership, limited partnership, sponsorship, and private capital lending. He focuses on data-driven investing to optimize returns and reduce risk.

Prior to creating Mosaic Equity Group, Dr Gabriel Bietz is a vascular surgeon. Former partner at PVA was one of the largest vascular surgery practices in North America, with 24 physicians and over 250 employees across South Texas.

He was a Advisory Board Member and product developer for Bluegrass Vascular Technologies aquired by Merit Medical (NASDEQ: MMSI) in June 2023.

Dr. Bietz completed his doctorate in Medicine from The Royal College of Surgeons in Ireland in 2006 and received his surgical training at the University of Kentucky. He holds three post-doctorate board certifications, including general surgery, vascular surgery, and vascular interpretation (RPVI). Dr. Bietz is a published author in clinical research and has played an active part in taking a medical device from conception to FDA approval. In addition to his successful medical career, Gabriel is happily married to Dr. Amita Kumar, and they have two wonderful children. In his spare time, he enjoys spending quality time with family, traveling, and sports.

Amer Kumar

Amer Kumar is the President and owner of Ashford Communities, a Houston-based multifamily real estate firm with a portfolio spanning over 5,500 units and more than $75 million in annual revenue. Amer leads the company’s strategic direction, operational excellence, and investment growth, driving innovation across property management, capital improvements, and resident experience.

With over a decade of experience in the real estate industry, Amer has developed deep expertise in finance, acquisitions, asset management, and marketing. Under his leadership, Ashford has implemented robust systems including Entrata and QuickBooks, scaled international accounting operations, and established a data-driven culture focused on performance, service, and community.

Amer holds executive education credentials from Wharton, MIT, Harvard, and Columbia, and is proficient in Spanish and Hindi. Known for his collaborative leadership style, Amer works closely with cross-functional teams, family partners, and investors to create sustainable value and inclusive communities.

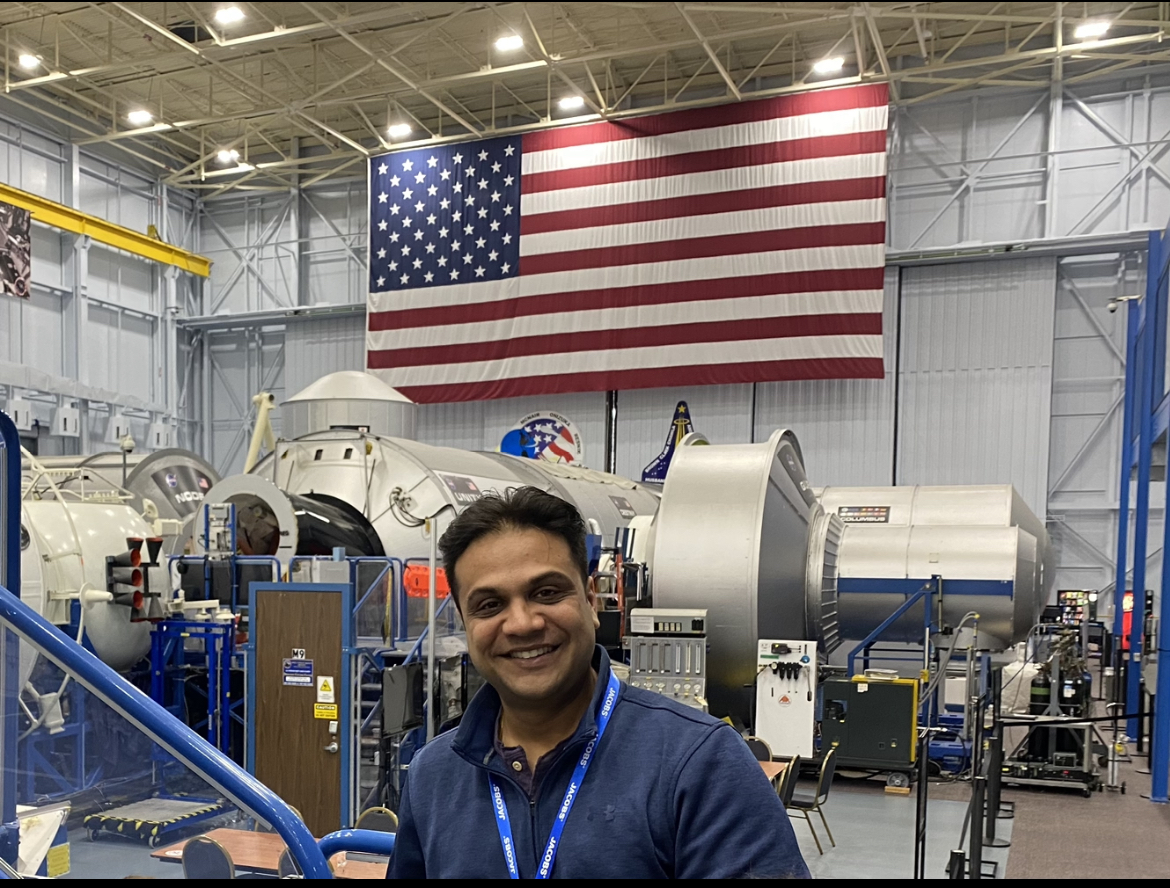

Shyam Parikh: Principal

Shyam Parikh is head of Investor Relations for Mosaic Equity Group. He has a background in finance and commercial real estate brokerage. Shyam has a passion for education and teaching investment strategy. He is a Founding Partner of Mosaic Equity Group.

In addition, Shyam is Project Manager of the VIPER project at NASA. The VIPER Project is a NASA mission to send lunar land rovers to the moon.

Shyam has a strong interest in applying new technology to the real estate community. He is an avid New Orleans Saints fan. He enjoys cooking and traveling to Japan in his spare time.

Mosaic Equity Group takes enormous pride investing capital in our private real estate offerings on behalf of our investors – both individuals and institutions. We believe every investor deserves access to the institutional-caliber, private real estate investments to preserve and grow wealth with us. We focus on multifamily assets with opportunistic equity and debt strategies. Our steadfast mission is to create long-lasting wealth for our investors through the meticulous stewardship of their capital.

Partners

Mosaic Equity Group maintains relationships with trusted tax, insurance, legal and accounting professionals who make up an important part of our deal team, contributing both to smooth deal execution, effective asset management and achievement of the business plan.

Sponsors

Mosaic Equity Group only invests with sponsors that have a proven track record, competence, experience, financial strength, and relationships. Our chosen sponsor must be vertically integrated, managing all aspects of the development continuum with a primary investment always focus on the preservation of capital and the achievement of high risk-adjusted returns